AI to the Rescue: Streamlining Payments with AI Agents

Artificial Intelligence has seen great improvement, especially in recent years. Every industry has been trying to figure out how to use it to simplify and improve processes, including the financial one. One of the trending use cases is using AI agents to streamline payments and transactions. Let’s delve into how this is being done and how it actually is a game-changer.

We all know how popular ChatGPT and other genAI platforms have become — be it to finish homework, to help plan that trip, or to learn how to cook a roast. However, there is much more to AI than meets the eye. We talked about how it’s being used to help tackle cybercrime, or how governments are creating entire complexes to develop powerful tools with artificial intelligence. Today, we’re exploring AI’s potential to simplify payment processes and transactions. The most common tool is AI agents, which are bots with decision-making capabilities and a certain degree of independence. The role of developers is to set the goals they want the agents to perform, while the bots’ job is to find the most clever ways to reach those goals.

Using AI to tackle major issues

There are a few areas where AI agents are becoming super handy, namely to detect and prevent fraud by flagging suspicious movements and alerting the authorities. They are also being deployed to automate transfers and KYC processes that are otherwise cumbersome and time-consuming, thus allowing the actual workers to focus on more important matters instead of having them do automated work. IVR (Interactive Voice Response) — a payment system where consumers pay through a phone call — systems have also been greatly improved with the help of AI-based technology. Cross-border payments were also made easy with AI. Through quick scans of global payment services and entities, AI agents are able to define the best route and course of action for transactions between foreign states.

Payments made easy with agentic AI agents

Utilizing AI in payment and financial services isn’t just about quickening and streamlining processes. It’s also about detecting fraud and personalizing customer services, among other things. It’s quite simple, really. If you had the chance to better secure your home by asking someone to do exactly that without having to figure out what the necessary steps were, wouldn’t you? That’s exactly what AI agents do when it comes to transactions and processes in finance. They achieve certain goals through actions they feel make the most sense.

Earlier this month, InvoiceCloud — a company that streamlines online payments for enterprises — announced it’s using agentic AI technology to enhance its e-bill presentement and payment platform “to make billing and payments faster, smarter, and easier — further automating labor-intensive workflows, reducing manual errors, and expediting decision-making for businesses and their customers.” But how does it work? The AI agents are “designed to automate critical payment processes, adapt to real-time transaction changes, and proactively address customer issues”. Besides helping to save time, money, and personnel, using artificial intelligence allows for lower margins of error and constant updates that humans are unable to perform in such a short time.

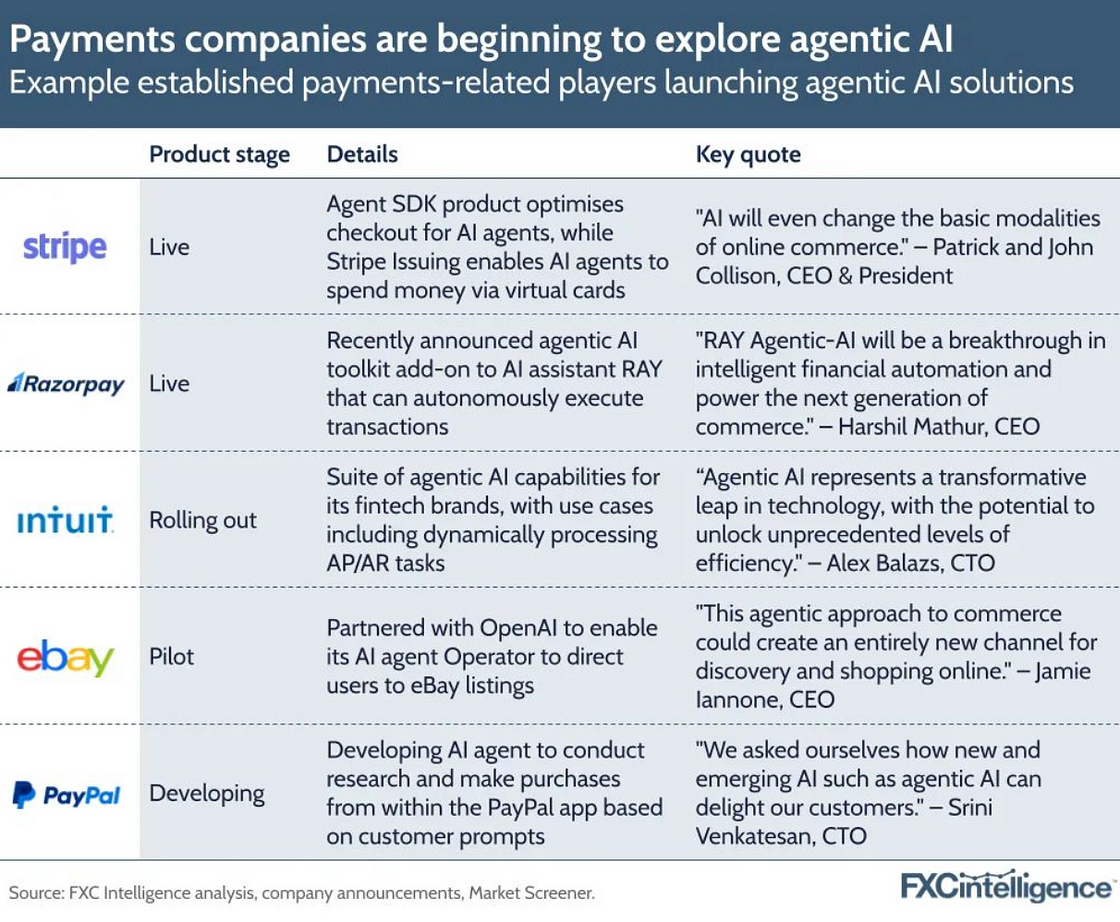

However, InvoiceCloud isn’t the only company making use of this technology. Big names like Mastercard, PayPal, and Coinbase are reported to be working with agentic AI in order to enhance their payment systems. Released in late April this year, Mastercard Agent Pay is the brand’s new solution that has AI agents as protagonists of the commerce journey, from start to finish: “Mastercard Agent Pay will enhance generative AI conversations for people and businesses alike by integrating trusted, seamless payments experiences into the tailored recommendations and insights already provided on conversational platforms.” According to Mastercard, it will work for everyone, from a 30-year-old planning her birthday to companies shipping goods worldwide. The new solution is part of the brand’s novel AI-based project, Agentic Payments Program.

Paypal is also investing heavily in agentic AI technology, going as far as building a Financial Operating System entirely dedicated to these digital beings. The news was unveiled at the Dev Days 2025, and according to Forbes, we’re not just talking about having AI agents helping out with purchases and online transactions. We’re talking about having AI-to-AI connections. Paypal is planning to use its own crypto token (PYUSD) to offer “a stable, programmable on-chain currency alongside fiat, opening the door to more inclusive and global agent-driven commerce.”

Mastercard and PayPal are both fiat-based projects, but these aren’t the only ones experimenting with AI-based payment services and systems. The crypto platform Coinbase has also been reported to be bringing back the HTTP 402 protocol — a status code “error” created in the 1990s to signal that the requested information will only be available after payment. The new protocol, called x402, “turns this 402 status code into a real payment layer — letting any server request payment, and any client (human or agent) respond with digital dollars in the form of stablecoins like USDC.” According to Finextra, Coinbase declares that “[AI] agents can now pay per API call — no human intervention, and no more managing payments for each integration.”

In a report focused on the evolution of AI, Gartner expects that by 2026, agents will automate 40% of enterprise workflows. The document delves heavily into the matter and explores the different ways in which AI agents are revolutionizing several industries, namely education, arts, fintech, logistics, manufacturing, and many others.

FXCintelligence, a platform focused on international payments research, argues there’s great potential for agentic AI applied to payments and transaction systems. Researcher Lucy Ingham says that new solutions are now being explored, and in early stages of development, the concepts look good. “Artificial intelligence attracted immense hype across 2024, but within that, we are beginning to see genuine impacts to products, solutions, and features, many of which have only been launched recently and which are likely to continue to see iteration and development over 2025 and into the next few years.”

AI agents for payments: true potential, or hyped trend?

As we showed, it appears to be real interest and investment being made into the development of solutions that involve using AI agents to facilitate payments and transactions online, not only with fiat, but also with crypto.

The idea looks great, but there are still questions of how it will work, how safe it is, and how it will be engineered to respect all the regulations in place, namely the EU’s AI Act. There are numerous ways to apply AI to payments or payments within AI use cases, and one of the concerns is its scope: will it be able to surpass cross-country legislation to enable international payments? How will KYC be performed? If AI agents take over the transactions, will the information about amounts and consumers’ identities be stored digitally? These are just a few questions that are yet to be answered, but it surely seems there’s room to explore — and succeed — the emergence of great innovative solutions regarding AI-based payment services.

Incognitee: Combining Automation & Privacy

Those who’ve been following Integritee for a while now might know we’ve been heavily working on Incognitee and enhancing the privacy-preserving platform’s features. We now offer users the chance to transact tokens, send messages, and create vouchers privately with different tokens, including DOT, USDC, USDT, EURC, and many more.

What if you could now do all this via AI agents, but privately, without having apps and third parties tracking your activity? That’s exactly what we’re working on! In this first phase, we are developing a privacy layer connecting users to Incognitee to use AI services. The aim is to enable users to access services like ChatGPT or Google Gemini in private mode, with no chance of these apps tracking your identity because you don’t have to sign up directly with those players. Honestly, who needs to have their AI searches recorded forever, or stored in some company’s server?

Once this is up and running, we intend to take Incognitee even further, enabling AI-agent-powered transactions and actions that are totally private.

• • •

About Integritee

Integritee is the most scalable, privacy-enabling network with a Parachain on Kusama and Polkadot. Our SDK solution combines the security and trust of Polkadot, the scalability of second-layer Sidechains, and the confidentiality of Trusted Execution Environments (TEE), special-purpose hardware based on Intel Software Guard Extensions (SGX) technology, inside which computations run securely, confidentially, and verifiably.

Community & Social Media:

Join Integritee on Discord | Telegram | Twitter | Medium | Youtube | LinkedIn | Website

Products:

L2 Sidechains | Trusted Off-chain Workers | Teeracle | Attesteer | Securitee | Incognitee

Integritee Network:

Governance | Explorer | Mainnet | Github

You Might Also Like

Metadata in Messaging: How It Works and Why You Should Be Wary of It

Monthly Wrap-Up August 2025: New AI Solution & TEER Bridge Imminent

Crypto Heist Stats: 2025’s Half Was Worse Than All of 2024, and It Will Get Worse

USA’s Project Crypto: Key Takeaways & What It Means for the Rest of the World

Power to the People: How Crypto is Financially Empowering Communities

Incognitee’s Privacy-Preserving Chatbot: Your Conversations Deserve Better Protection

Monthly Wrap-Up June 2025: Introducing Incognitee’s ChatGPT Integration, Discussing Web3 Approaches & More

US vs EU: Two (very) Different Approaches to Web3 Regulation

Monthly Wrap-Up May 2025: Exploring Payments with AI, TEER Trending on Kraken & More

AI Isn’t Safe from Cybercriminals: Main Threats & How to Mitigate Them

Using AI to Fast-Track Digital Transformation in Governments: Good or Bad?

Cybersecurity: Combining AI & Proxy Tech to Fight Crime

The Digital Euro is the EU’s Next Big Thing — But at What Cost?

Cybercrime: Healthcare & Crypto Hit Hard, Scams on the Rise

K-Anonymity: An Important Tool to Achieve Collective Privacy

On Anonymity in Web3

Web3 2025 Predictions: What’s Going to Happen This Year?

Blockchain and Cybersecurity: Can Decentralization Solve the Biggest Security Challenges?

The Evolution of Smart Contracts: What’s Next?

Cross-Chain Interoperability: Major Issues & How to Tackle Them

Different Types of Crypto Wallets: All You Need to Know

Series 2 – The Integritee Network | Episode 8 – Integritee’s SDK

Series 2 – The Integritee Network | Episode 7 – The Attesteer

Series 2 – The Integritee Network | Episode 6 – The Teeracle

Series 2 – The Integritee Network | Episode 5 – Trusted Off Chain Workers

Series 2 – The Integritee Network | Episode 4 – Integritee Sidechains

Series 2 – The Integritee Network | Episode 3 – Integritee Technology

Series 2 – The Integritee Network | Episode 2 – Integritee Architecture & Components

Series 2 – The Integritee Network | Episode 1 – Introducing Integritee

Series 1 – All you need to know about TEEs | Episode 6 – TEE Limitations

Series 1 – All you need to know about TEEs | Episode 5 – TEE Principles & Threat Models

Series 1 – All you need to know about TEEs | Episode 4 – TEE Application Development

Series 1 – All you need to know about TEEs | Episode 3 – TEE Technologies